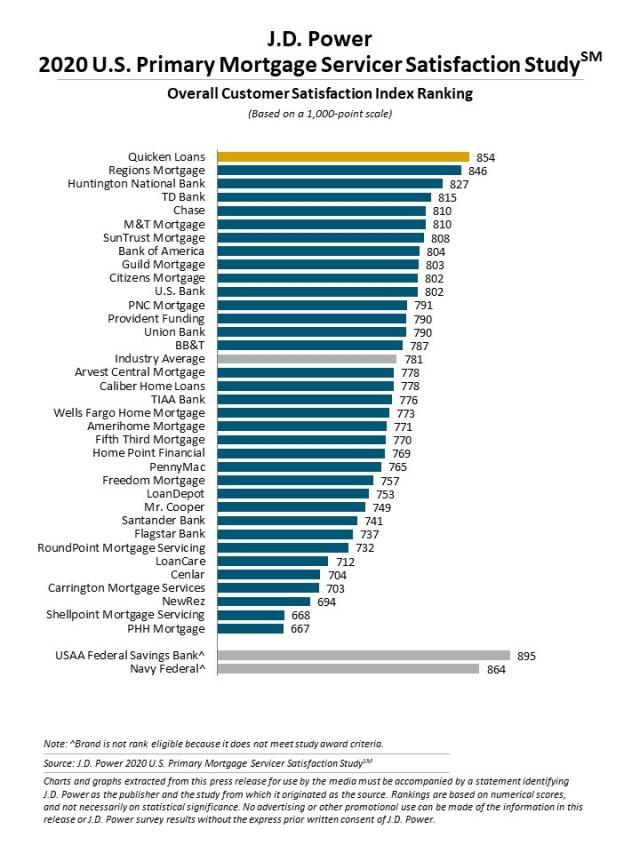

Mortgage servicers have been put to the test during the COVID-19 pandemic as a combination of historically low interest rates, record high unemployment and rising delinquencies have created a surge in customer inquiries. According to the J.D. Power 2020 U.S. Primary Mortgage Servicer Satisfaction Study,SM released today, that surge is being met with more website utilization, long wait times with call centers and very little proactive communication—all of which drag down overall customer satisfaction scores.

“The COVID-19 pandemic has really amplified the gaps in customer satisfaction, digital experience and call center experience that have been a challenge for mortgage servicers for some time,” said Jim Houston, director of consumer lending intelligence at J.D. Power. “At a time when the need for streamlined, effective digital guidance and proactive outreach and counsel is more important than ever, mortgage customers aren’t finding the answers they need online, pushing them onto long customer service queues in call centers and leaving them to hunt for answers on how best to address their challenges.”

The good news is that average industry satisfaction is up from 2019 and many of this year’s findings are forward looking, providing lenders with a clear line of sight to what consumers want and expect.

Following are some key findings of the 2020 study:

- Websites need to do more heavy lifting: More than three-fifths (62%) of customers visit their lender’s website as a first line of information but only 28% say online is the most effective channel by which to resolve an issue. Among those who couldn’t resolve their issue on the lender’s website, 45% say the issue was resolved only after picking up the phone to speak with a representative. Given that websites are relied on for common customer activities, lenders need to make sure that their websites are more effective in helping customers resolve issues.

- Traditional channels must work effectively: Nearly one-fifth (19%) of customers say it is not easy to contact a live agent via the telephone. This negative experience causes a 261-point drop (on a 1,000-point scale) in satisfaction for those consumers looking to use this traditional channel.

- Customer fears likely to drive increase in calls: Nearly half (44%) of at-risk customers called their servicer in the last 12 months vs. 25% for low-risk customers. At-risk customers also call an average of 3.15 times vs. 2.54 for low-risk customers. As the rate of at-risk customers grows, lenders should expect elevated call volumes that will challenge call centers already dealing with work-at-home limitations.

- Finding right balance with proactive communications: Customers who receive three or four proactive communications per year from their mortgage lender have the highest levels of overall satisfaction, which is represented by an average score of 810. Yet, only 8% of customers indicate receiving this level of communication. Far more—40%—say they’ve received no proactive communication from their lender, and 29% say they’ve received 11 or more proactive communications. Too few or too many communications cause satisfaction scores to decline.

- A simple “thank you” goes a long way: When it comes to lender communication with customers, the factor with the single greatest effect on customer satisfaction is thanking customers for their business. Satisfaction scores increase by 86 points when lenders thank customers for their business, yet just 22% of lenders do this.